nh transfer tax calculator

To estimate your tax return for 202223 please select the. The assessed value multiplied by the.

Rate Calculator Nh Absolute Title Llc New England S Premier Title Company

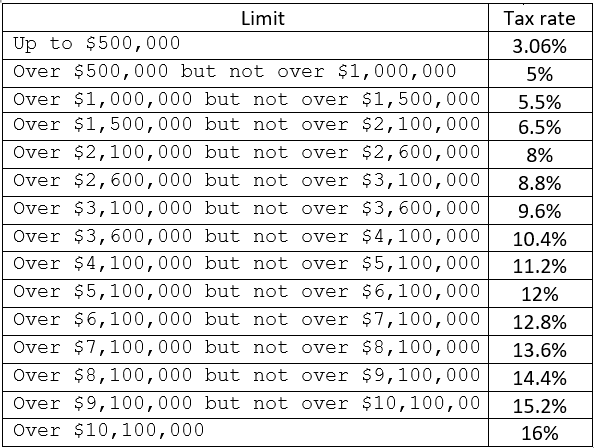

NH Real Estate Transfer Tax Rate Table Purchase price rounded up to the next 100 x 015 Tax is rounded up to the next dollar amount 40 minimum tax for purchase less than 4000.

. The tax is imposed on both the buyer and the seller at the rate of 75 per 100 of the price or consideration for the sale granting or transfer. How much is the real estate transfer tax in New Hampshire. New Hampshire Gas Tax.

The average effective property tax rate in. To an otherwise taxable transfer between a land trust incorporated under RSA 292 and established to provide affordable housing to low-income people and a housing cooperative. NJ Transfer Tax Calculator Customarily the New Jersey Transfer Tax is paid by the seller and the Mansion Tax on residential or commercial purchases of 1 million or more is paid by the buyer.

The assessed value multiplied by the tax rate equals the annual. The statute imposing the tax is found at RSA 78-Band NH Code of Administrative Rules Rev. From to transfer tax tax2 4001 4100 62 31 4101 4200 63 32 4201 4300 65 33 4301 4400 66 33 4401.

Select PUD if property is in a Homeowers Association. On any amount above 400000 you would have to pay the full 2. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

Nh transfer tax calculator. Who pays the transfer tax in New Hampshire. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000.

New Hampshire Income Tax Calculator 2021 If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The RETT is a tax on the sale granting and transfer of real property or an interest in real property. Monday Friday 800 AM 400 PM.

New hampshire salary tax. May vary by property location please contact office for amount. New Hampshire Salary Tax Calculator for the Tax Year 202223 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

4500 2 2250. The New Hampshire State Tax Calculator NHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases.

Your average tax rate is 1198 and your. Assessing Tax Calculator The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access.

.jpg)

Pa Uc 2 And Uc 2a Calculation Das

Tax Preparation Assistance Through Vita Franklin Nh

Tax Calculator Return Refund Estimator 2022 2023 H R Block

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

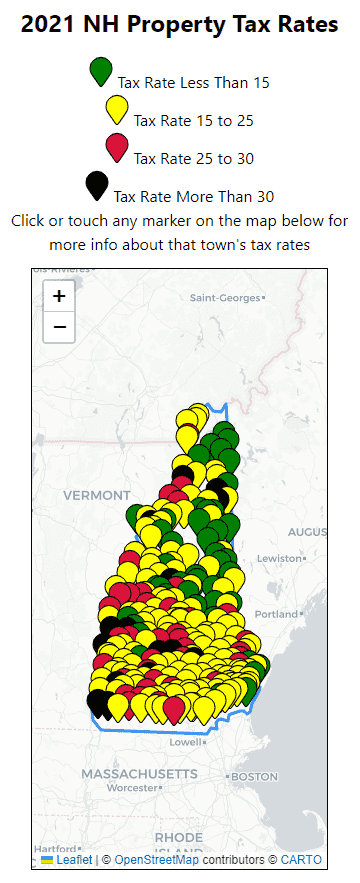

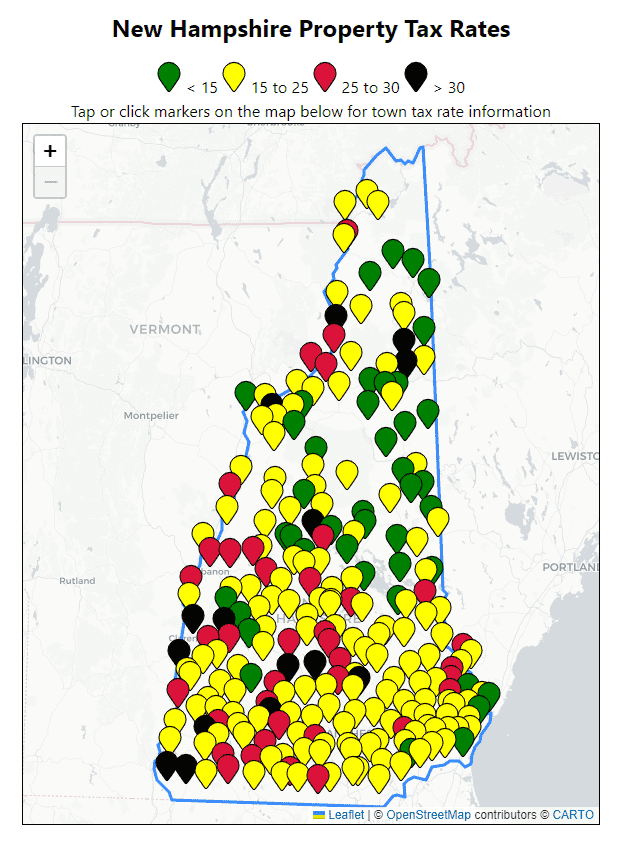

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

Transfer Tax Definition Examples Calculate Transfer Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Derry Establishes Tax Rate At 26 12 Town Of Derry Nh

2023 Tax Brackets Here Are The New Irs Income Thresholds Money

Deducting Property Taxes H R Block

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Homebuyer Tax Credit New Hampshire Housing

2022 Casella Sustainability Award Town Of Stratham Nh

All Current New Hampshire Property Tax Rates And Estimated Home Values

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Calculate Your Transfer Fee Credit Iowa Tax And Tags