are inherited annuity payments taxable

For instance if buy the annuity for 100000 and receive 6000 annually in payments. All payments beyond the annuitants life expectancy are taxed as income.

Annuity Taxation How Various Annuities Are Taxed

When you receive payments from a qualified annuity those payments are fully taxable as income.

. The facts are the same as in Example 1. Exclusion not limited to cost. Inherited non-qualified annuity with another company.

But annuities purchased with a Roth IRA or Roth 401k are completely tax free if certain requirements are met. The exclusion ratio for a fixed annuity is the ratio the investment in the contract bears to the expected return under the contract. Also you must report the entire amount to the.

To transfer the death benefit proceeds to a decedent IRA or inherited non-qualified annuity at another company the following paperwork must be completed in addition to this form. After that your annuity payments are generally fully taxable. Additional requirements may exist at the receiving company.

The taxable and non-taxable portions of the payments are determined by an exclusion ratio. If you chose a joint and survivor annuity your survivor can. Thats because no taxes have been paid on that money.

If your annuity starting date is before 1987 you can continue to take your monthly exclusion for as long as you receive your annuity. This is based on how long your annuity was how much money you paid in and how much money you got out. If a non-qualified annuity pays the owner payments for their entire life the exclusion ratio will take their life expectancy into consideration.

Last In First Out LIFO.

How Are Annuities Taxed For Retirement The Annuity Expert

Annuity Tax Consequences Taxes And Selling Annuity Settlements

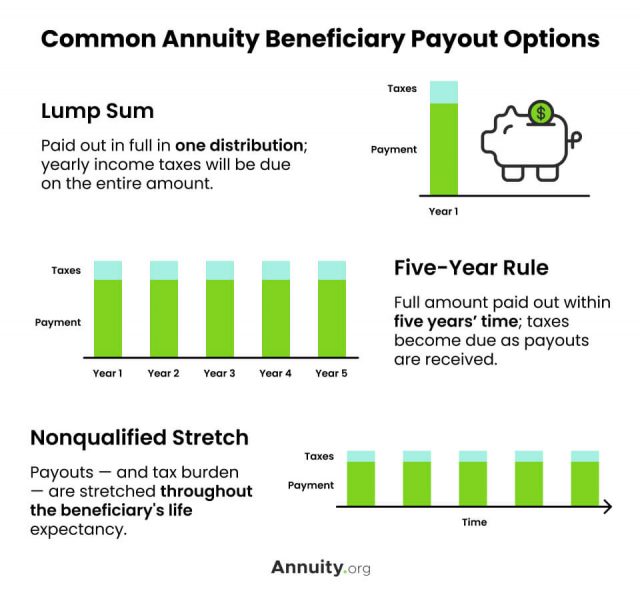

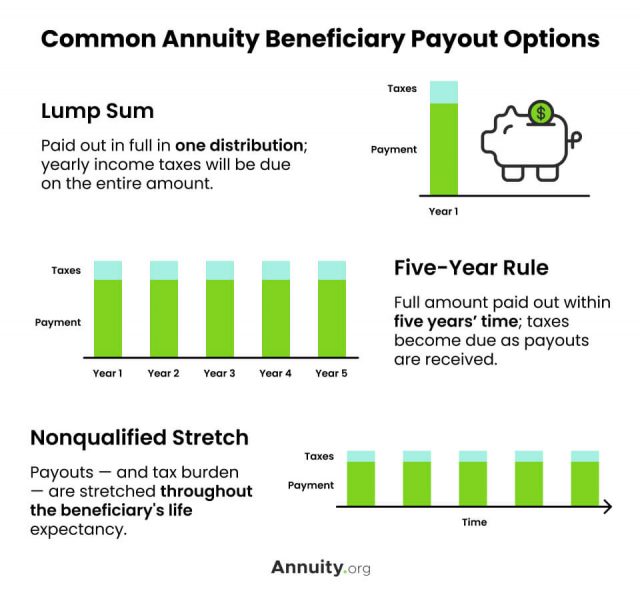

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Taxation How Various Annuities Are Taxed

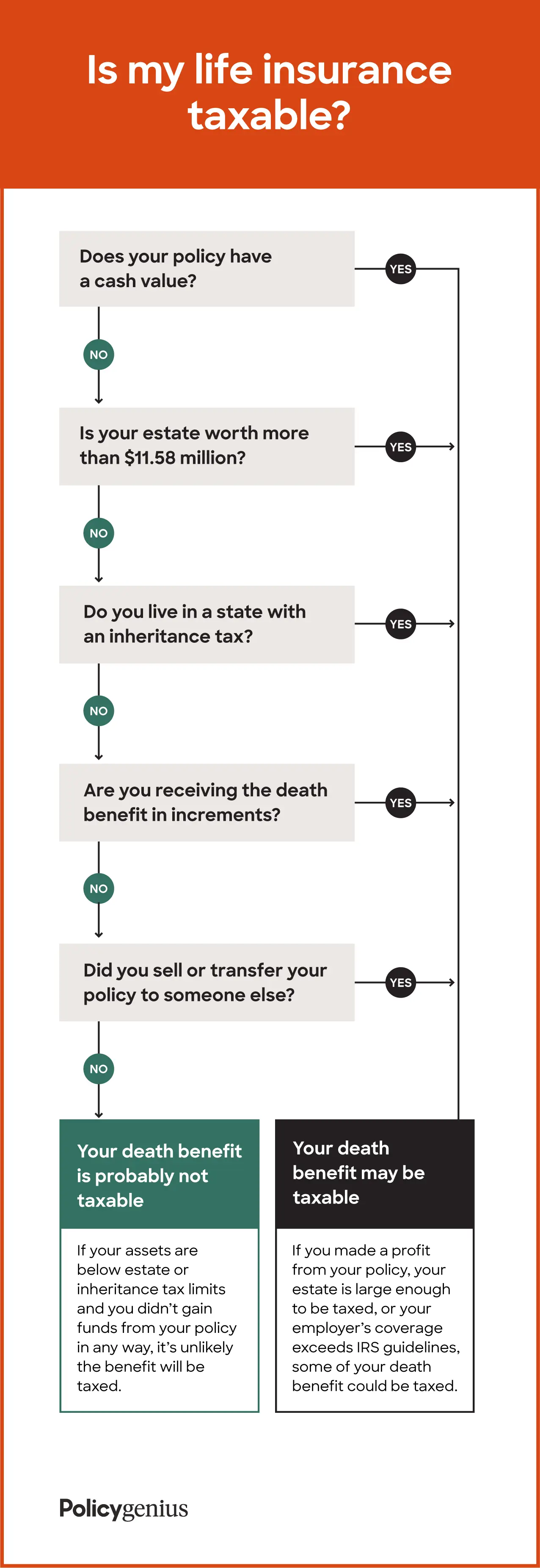

Is Life Insurance Taxable Policygenius